Working with Home Buyers

I Have a Lead, What Do I Do?

Call Right Away Regardless of Source

Contact your leads right away, no matter where they came from—every lead has potential! While some sources might be more promising than others, it’s important not to discount any lead. Many prospects use multiple channels to search for homes, so every opportunity counts. Remember, most agents rely solely on emails, which aren’t as effective as a direct phone call. Always make that call promptly and keep in mind that the worst they can say is no.

Continue to Follow Up

Follow up with both a text and email, regardless of whether you were able to reach them by phone. Leads often want to verify your credibility and have a written way to contact you back. In today’s digital world, having an online presence is crucial for your business. If you don’t receive a response, keep trying to reach them through multiple attempts. If there’s still no reply, you can set them up on a smart drip plan to automate your follow-ups. Join our kvCORE Training to learn more about creating effective Smart Drip Plans!

Set Clients Up On Search Alerts

On Day 1, set up an E-Alert in kvCORE or your MLS, even if you weren’t able to reach the lead by phone. This alert can be based on the original property they inquired about, providing them with relevant information about the listing. Sending this useful content, branded with your contact details, keeps you top-of-mind. It also gives the lead a way to request a showing directly from the alert, increasing the chances of engagement. This proactive approach ensures you’re consistently providing value and staying connected with potential clients.

Scheduling Showings

Ask the lead for their preferred date and time for showings, and inquire if there are any other homes they’re interested in seeing, even if they found them outside your website. Many leads may not realize you can arrange viewings for any property they’re interested in. Aim to schedule multiple showings at once, so if one home goes pending, you can still meet them in person at the other properties.

Meeting in person, or even via live virtual tours, is essential for building a working relationship. According to a study by OpCity, 90% of leads who closed deals had met their agent within the first two weeks. Organize the showings geographically if possible and follow the MLS instructions for each property. Confirm each showing with the listing agent beforehand.

Arrive early to open the homes, bring MLS printouts for your clients, and a broker synopsis for yourself to address any questions. Try to schedule your next meeting with them while you’re there to keep the momentum going and ensure you have future appointments lined up.

If A Lead Is Interested in A Home

Address their questions promptly, and if you don’t have the answer, get in touch with the listing agent to find out and follow up with the information as quickly as possible. Prepare a Comparative Market Analysis (CMA) to show them the current value of the home. Keep in mind that in the current market, the “market price” (what buyers are willing to pay) can often exceed the listing price, so be sure to communicate this as well.

Additionally, ask the listing agent about the number of offers received, the deadline for the highest and best offers, and any other factors the seller is considering beyond just the price. There are many elements to consider in an offer, not just the financial aspect.

I Have a Lead, What Do I Do?

If A Lead is Interested in a Home

Respond to their questions promptly. If you don’t have an immediate answer, reach out to the listing agent to gather the necessary details and follow up quickly. Provide a Comparative Market Analysis (CMA) to show the current value of the home, but also note that in today’s market, the “market price” (what buyers are willing to pay) may be higher than the listing price.

Also, check with the listing agent about the number of offers they’ve received, the deadline for the highest and best offers, and any additional criteria the seller is considering beyond the price. Remember, there are many factors to weigh when making an offer, not just the financial terms.

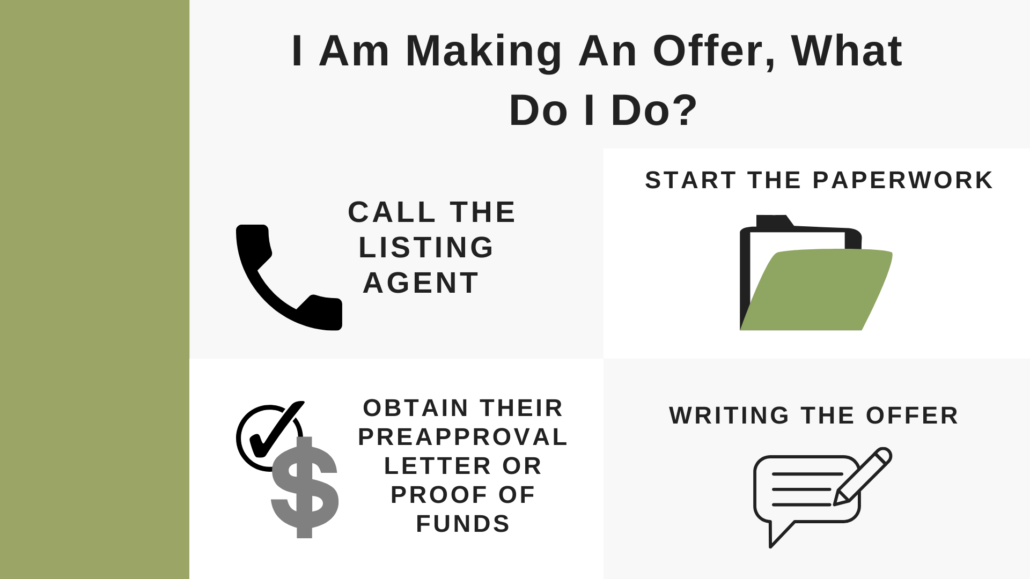

Call the Listing Agent

If you haven’t done so yet, contact the listing agent to find out the total number of offers they’ve received, the deadline for the highest and best offers, and any seller priorities beyond price. Factors such as the closing date, possession date, cash versus financing, or the length of the inspection period can be equally important to the seller.

Obtain Pre-Approval Letter or Proof of Funds

Request a pre-approval letter from your client’s lender, as offers without one are often not considered in the current market. If they need a lender recommendation, you can suggest one of our two Preferred Lenders: Pioneer Mortgage Funding or MiMutual Mortgage. For cash offers, ask for proof of funds, which they can obtain from their bank or through their online banking portal.

Start the Paperwork

Create a buy-side residential loop in Dotloop. The contract will automatically populate, along with any Dalton Wade disclosures. You’ll need to add any relevant addendums, such as HOA, CDD, lead paint, etc., which you can find on the MLS or request from the seller. Include your own addendums if necessary, such as FHA/VA or Appraisal Contingency. Join Dotloop training for further guidance.

Writing the Offer

Discuss all the offer terms with your buyer, as there are many factors beyond just the price. Key terms to review include: deposit amounts, down payment (which is different from the deposit and can be a crucial mistake if confused), financed amount, acceptance deadline, closing date, loan type, loan application deadline, loan commitment deadline, who covers title insurance, title commitment deadline and cure period, appraisal deadline/contingency, home warranty, special assessments, flood insurance deadline, inspection period deadline, assignability, lease conditions, and HOA application deadline. Attend one of our upcoming full contract training to learn more. We offer contract training for every state!

Send for Signature

Send all documents to your buyer through Dotloop for their electronic signature. Once they sign, copies will automatically return to your loop.

Send to the Listing Agent

Email the signed contract, addendums, seller disclosure, and preapproval/proof of funds to the listing agent, along with a brief but compelling description of your client. As the offer deadline approaches, follow up to ensure you receive a response, as not all listing agents will notify you if your offer isn’t accepted. If the seller wishes to negotiate, assist in the negotiations to secure the best deal for your client while keeping the seller engaged in this competitive market.

I Am Under Contract, What Do I Do?

Get the Fully Signed Contract Back & Confirm All Deadlines

Ensure you receive the fully signed contract, seller disclosure, and all addenda. Confirm with the listing agent that you both agree on all deadlines, including the effective date. This date marks when the last party signed and provided copies to the other party.

Get the Signed Contract Documents to All Parties

Immediately send the contract and addenda to the title company, lender, listing agent, and your buyer—don’t assume the other agent has taken care of this. Inform your buyer of all contract deadlines in writing, preferably in a detailed email, and ensure you assist them in meeting each deadline.

Submit Paperwork in Dotloop in a Timely Manner

To protect both you and the company from potential legal issues, our compliance department needs to review your paperwork. Please submit all documents promptly, ideally within 48 hours of signing. Attend our Dotloop training to learn more about the process.

Schedule Inspections

As soon as you’re under contract, schedule the home inspection, and if required or desired, the termite inspection (especially for VA/FHA loans). Recommend licensed and reputable vendors if needed, and coordinate with the listing agent to confirm a date and time that works for the seller, as the inspection will take several hours. It’s a good idea to attend the inspection so you’re fully informed about any issues. Buyers can also review public records about the home and arrange additional inspections if needed, such as for the roof or seawall.

Deposit Deadline

Ensure your buyer submits their deposit to the title company by wire transfer or check before the deadline—usually within 3 days or less. Advise them not to mail it, as there won’t be enough time for it to arrive.

Loan Application Deadline

Ensure your buyer completes the loan application with their preferred lender before the contract deadline, which is typically 5 days. Provide proof to the listing agent that the application has been submitted to safeguard the buyer’s deposit.

Inspection Deadline & Insurance Shopping

Once the home inspection results are back, ensure your buyer reviews them and communicates any repair or credit requests to the other agent.

Have your buyer check with insurance companies to confirm the home’s insurability during the inspection period. This will help identify any issues early, so you can address them before the deposit becomes non-refundable. Depending on the home’s age, a 4-point inspection report might be required—consult with your preferred insurance company for details.

If the home is not insurable, request the necessary repairs, as insurance is mandatory for financed deals and you want to avoid complications at the last minute. If flood insurance is needed, try to obtain a prior elevation certificate from the seller to get an estimate. Negotiate any repairs or credits before the inspection period deadline, and make sure to formalize these agreements in writing through a fully signed addendum to protect the buyer’s deposit.

Homeowner Association Documents

If the home is part of a condo or homeowners association, request the necessary documents from the listing agent. Always obtain the Property Management Company’s contact information as well, so you can verify that you have all required documents, as sellers may not provide everything your buyer needs to review.

Your buyer will have 3 days from receiving the complete set of documents to review them and decide if they are acceptable, or to cancel the deal for a deposit refund. Ensure you obtain the declaration, articles of incorporation, bylaws, rules and regulations, ARC guidelines, buyer application (if applicable), any amendments, and the most recent financial statements.

Title Documents: Title Commitment, Lien/Permit Search, HOA Estoppel, Survey/Elev Certificate

Throughout the transaction, the title company will order and obtain several documents. This will include a title commitment and lien search, which you should request to review for any issues. At the start of the process, request a permit search to check for any open permits.

If the property is part of an association, the title company will order an HOA estoppel. Once it’s available, review it for any violations, special assessments, buyer application requirements, lawsuits, fees, etc.

For fee-simple properties that are financed, a survey is required, and an elevation certificate is needed if the property is in an AE flood zone. Ask the listing agent early in the process if the seller has a survey or elevation certificate. If they do, you can provide it to the title company and use it instead of ordering a new one (*restrictions may apply).

Ensure you provide all documents to your buyer for review as soon as you receive them.

Loan Commitment Deadline

If your transaction is financed, ensure you obtain a loan commitment from the lender by the deadline specified in the contract to protect your buyer’s deposit. Request this commitment from the lender promptly. If it’s not available by the deadline, seek a written extension signed by all parties.

If the seller refuses to extend the deadline, your buyer has the option to either proceed and waive their financing contingency, risking their deposit but hoping to close with the loan, or cancel the contract to recover their deposit before the deadline. If you decide to move forward, notify the seller in writing to prevent them from canceling the agreement after the deadline has passed.

Commission Disbursement Authorization

Complete your CDA and have it signed by us at least 10 days before closing. Submit it to the title company to ensure you receive your payment at the closing table. The title company will then mail us your check.

Remind Clients to Set Up Utilities

Remind your buyer to contact the water, electric, trash, internet and gas companies a few days to a week before closing to set up service in their name starting on the closing date. The seller will also contact these companies to disconnect services, so it’s important to ensure a smooth transfer of ownership with no interruption in service for the final walkthrough.

Schedule the Final Walkthrough & Closing

Arrange a final walkthrough of the property with your buyer for the day before or the day of closing, ensuring it aligns with the seller’s schedule. This is a great time to make sure the home is left in the same condition, if not better, from when your buyer visited the property originally. Also, schedule a time to sign closing documents at the title company. If your buyer is out of the area, inform the title company in advance and remind them to arrange a mobile notary for your buyer’s signature.

Closing Disclosure

If your transaction is financed, TRID regulations require that your buyer receive a Closing Disclosure from the lender at least 3 business days before closing. If this isn’t provided in time, the closing must be rescheduled.

Buyer Wire

Ensure your buyer wires the funds for their final amount to the title company, as checks, cash, or money orders are not accepted. They should send the wire transfer the day before or early on the day of closing, which is typically when they receive their final figure from the title company. Have your buyer confirm the wiring instructions by phone with the title company contact information you provided earlier to avoid the risk of wire fraud from intercepted emails with fraudulent wiring instructions.

Attend the Final Walkthrough & Closing

Accompany your client to the final walkthrough of the home. Ensure they inspect the property to confirm it meets their expectations and check that the water, gas, and electric are on so they can test any features. Verify that any negotiated repairs are completed to their satisfaction. Have your client sign the Dalton Wade Final Walkthrough form. Attend the closing with your buyer, and consider giving them a closing gift as a thoughtful touch!

Post Closing

After closing, update your Zillow and Realtor.com profiles with the details of the sale and promote it on your social media business pages. Use your own photographs if you weren’t the listing agent, as listing agents’ photos are their intellectual property. Request reviews from your clients and follow up if they don’t leave a review immediately (reviews can be posted on Zillow, Realtor.com, Facebook, Google, etc.). Continue to stay in touch with your clients, as you never know when they might need your services again or refer you to others.